Improve US Cash Flow: Top Outsource Accounts Receivable Services

outsource accounts receivable services can make a game-changing difference. Instead of hiring additional in-house staff or overburdening your finance team, outsourcing your accounts receivable (AR) processes helps you speed up collections, reduce overhead, and keep your cash flow healthy without sacrificing client relationships.

For any US business, cash flow is the lifeblood that keeps operations running smoothly. You might have excellent sales numbers and loyal customers, but if invoices aren’t collected on time, your financial stability can quickly take a hit. This is where outsource accounts receivable services can make a game-changing difference. Instead of hiring additional in-house staff or overburdening your finance team, outsourcing your accounts receivable (AR) processes helps you speed up collections, reduce overhead, and keep your cash flow healthy without sacrificing client relationships.

Why Cash Flow Matters More Than Ever for US Businesses

In today’s competitive market, customers expect flexibility, suppliers demand timely payments, and unexpected expenses can arise at any time. Even profitable companies can face serious challenges if cash is tied up in unpaid invoices.

Strong cash flow enables you to:

-

Cover operational expenses without stress

-

Take advantage of early payment discounts from suppliers

-

Reinvest in growth and innovation

-

Navigate seasonal fluctuations with confidence

If your DSO (Days Sales Outstanding) is climbing or you’re seeing frequent payment delays, it may be time to consider outsourcing AR functions.

What Are Outsource Accounts Receivable Services?

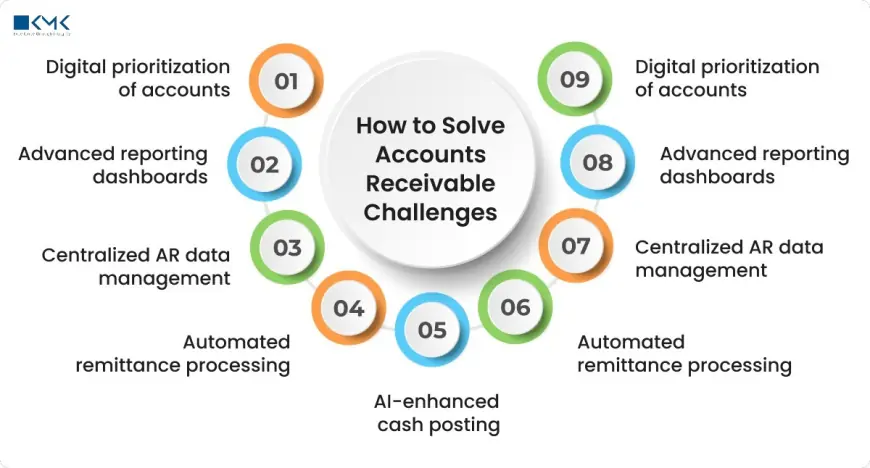

Outsource accounts receivable services involve hiring a specialized third-party provider to handle your invoicing, payment reminders, collections, dispute management, and cash application. These service providers combine financial expertise with advanced AR automation tools to ensure that payments are collected faster and more efficiently.

Typical services include:

-

Invoice creation and distribution

-

Automated payment reminders

-

Follow-up calls and email outreach

-

Dispute resolution

-

Cash application and reconciliation

-

Detailed reporting and analytics

How Outsourcing AR Improves US Cash Flow

Outsourcing AR isn’t just about cutting costs — it’s about building a smoother, more predictable revenue cycle. Here’s how it benefits cash flow directly:

1. Faster Payment Collection

Professional AR teams use consistent follow-up schedules and personalized reminders to encourage on-time payments, reducing the number of overdue accounts.

2. Reduced DSO

Lower Days Sales Outstanding means your business has cash in hand faster, enabling you to cover expenses and invest without relying heavily on credit.

3. Streamlined Dispute Resolution

AR specialists handle invoice disputes promptly, ensuring small issues don’t cause big payment delays.

4. Automation for Accuracy

With cloud-based AR software, you can automate invoice delivery, payment tracking, and reminder scheduling — minimizing human errors and missed follow-ups.

Top Outsource Accounts Receivable Services for US Companies

When choosing a provider, you want a partner that understands US business regulations, offers scalable services, and maintains professional client communication. Here are some leading types of outsourced AR services to consider:

1. Full-Service AR Management

Covers the entire process from invoice creation to final payment. Best for companies that want to completely offload AR functions and focus on core operations.

2. Invoice Processing and Automation

Ideal for businesses that already manage follow-ups in-house but need help with accurate, fast invoice creation and distribution.

3. Collections-Only Services

For companies with strong internal billing but challenges in chasing overdue accounts, these services focus on polite yet persistent collections.

4. Industry-Specific AR Services

Some providers specialize in sectors like healthcare, manufacturing, law, or e-commerce, tailoring their approach to industry-specific billing cycles and compliance requirements.

Why US Businesses Are Turning to Outsourced AR

Outsourcing is growing in popularity across the US for several reasons:

-

Scalability – You can handle seasonal peaks without hiring more staff.

-

Cost savings – Pay only for the services you use, avoiding full-time salaries and benefits.

-

Access to expertise – Work with AR specialists who know the best strategies for improving payment speed.

-

Better customer experience – Professional teams use respectful, brand-aligned communication to maintain positive client relationships.

Addressing Common Concerns

“Will I lose control over my AR process?”

No — reputable providers offer real-time dashboards and detailed reports, so you always have visibility into your receivables.

“Will my customers react negatively?”

Professional AR teams are trained to communicate politely, focusing on resolution rather than confrontation, often improving payment timelines without harming relationships.

“Is it secure to share financial data?”

Yes — leading AR outsourcing companies follow strict data security and compliance protocols like SOC 2, HIPAA (for healthcare), and GDPR.

How to Choose the Right Outsource Accounts Receivable Partner

Before committing, evaluate potential providers based on:

-

Industry experience – Have they worked with businesses like yours?

-

Technology – Do they use modern AR automation tools?

-

Reporting – Will you receive detailed, transparent reports?

-

References – Can they provide client testimonials or case studies?

-

Flexibility – Can they customize services to your needs?

Steps to Start Outsourcing AR

-

Evaluate current AR performance – Measure DSO, overdue accounts, and staff workload.

-

Identify pain points – Determine where delays or inefficiencies occur.

-

Set clear goals – Define KPIs like reduced DSO, faster collections, or improved cash application accuracy.

-

Select a provider – Compare services, costs, and technology capabilities.

-

Run a pilot program – Test outsourcing on a portion of your AR before full implementation.

-

Monitor and adjust – Track results and refine processes for ongoing improvement.

The Bottom Line

In the US business landscape, cash flow is king. The faster you turn invoices into cash, the more agile and competitive your company becomes. Partnering with a provider of outsource accounts receivable services gives you access to skilled professionals, advanced technology, and proven processes — all designed to get you paid faster without overloading your internal team.

If your receivables are growing faster than your cash balance, now is the time to explore outsourcing. You’ll streamline operations, protect your customer relationships, and strengthen your financial foundation — all while keeping your workforce lean.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0